Have you made that all-important New Year’s resolution to save money and pay down debt? Then don’t churn through four different credit cards with high, variable interest rates. Cedar Point has a low, fixed-rate credit card that could help you reach your financial goals faster. Transfer your balances to a Cedar Point credit card and you could save on interest in the new year.

What’s a Credit Card Balance Transfer?

A balance transfer is simple. You apply for a new card with a lower interest rate than your current card. Then, you request to transfer your balance from that card to the new one. Essentially, you’re moving credit card debt from one credit card to another to save money on interest. Do you carry balances on multiple credit cards? You can transfer multiple balances to a Cedar Point credit card for a simpler monthly payment.

When you transfer your balances to a Cedar Point credit card, you can consolidate your debt while also accessing a lower, fixed rate. Lower rates can potentially help you save money on your monthly payments and pay off your debt sooner. Here’s how:

- Make it simple: Turn multiple payments into one payment

- Lock in a low rate: Cedar Point offers consistently low rates

- Fixed rate: There is no penalty rate or variable rate

- Pay it down: With a lower rate, you can pay down debt faster

- No balance transfer fee: You can concentrate on saving

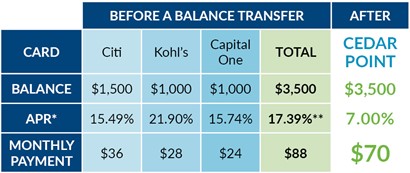

Below is an example of what your monthly interest savings might look like if you transfer your balances to Cedar Point. In the scenario below, your monthly payment would be reduced by $18. Over time, those savings really add up.

Visit cpfcu.com/balance-transfer to learn more and apply for a Cedar Point credit card.

Federally Insured by NCUA.