Has your financial situation changed since you first financed your vehicle? It might be wise to consider refinancing your loan, which can offer many money-saving benefits for both new and used auto loans. This is especially true if you currently have a high-interest rate or a monthly payment that doesn’t work for your budget. Here are four reasons to consider refinancing your auto loan.

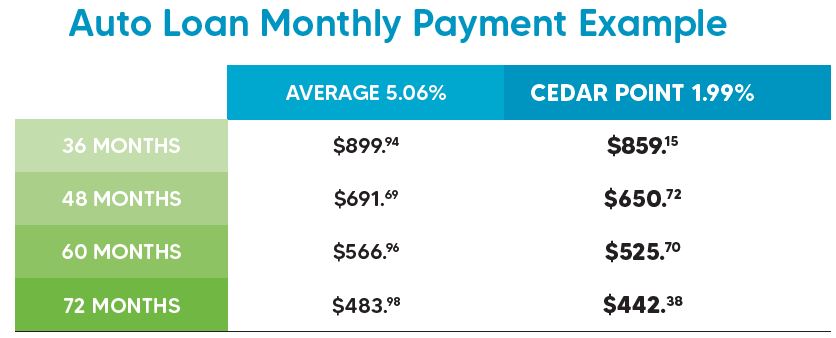

- Lower Your Interest Rate What’s the current interest rate on your auto loan? If it is over 1.99% APR for a new car or over 2.49% APR for a used car, you are missing out on a serious money-saving opportunity. Cedar Point offers these low rates and can refinance your loan to help you save money on interest over time. Even if you just bought a new vehicle in the last six months, it’s worth it to explore your options. After all, simply lowering your interest rate could possibly save you hundreds of dollars over the life of the loan.

- Change Your Monthly Payments If your monthly payment is too high, refinancing could help lower your monthly payment. With a lower monthly payment, your budget will have more flexibility so that you can afford life’s other essential necessities. On the flip side, if you now have more flexibility in your budget and can afford to pay more per month, a refinance could help you pay off your loan sooner by making a higher monthly payment.

- Change Your Term Length Besides lowering your rate and monthly payment, refinancing also allows you to change your term length. Whether you need more time to pay off the loan or would like to pay it off sooner, changing the term length gives you more control. Cedar Point offers term lengths between 36 and 84 months with varying interest rates.

- Your Credit Score Improved Has your credit score changed since you financed your vehicle? If you have taken steps to improve your credit score, such as making on-time payments, your credit score may have improved. With a higher credit score, you might qualify for a lower interest rate. If you are a Cedar Point member, you can monitor your credit score for free using the digital banking platform. If you find your credit score has improved, it’s a smart move to explore refinancing.

Ready to Refinance?

Now that you understand the benefits of refinancing your auto loan, stop by any Cedar Point location to discuss your options with a Member Service Representative. Our experienced credit union staff can help you determine a course of action to get you on the road to savings. For more information, visit cpfcu.com/auto.